In this Startup Strategy series, we’ve already covered why you should start your own business, how you should test your business idea, and how you should conduct business market research. If you’ve already gone through those steps and realised that your business idea is very much viable, then it is time for you to get down to the nitty-gritties of setting up your business.

In this Startup Strategy series, we’ve already covered why you should start your own business, how you should test your business idea, and how you should conduct business market research. If you’ve already gone through those steps and realised that your business idea is very much viable, then it is time for you to get down to the nitty-gritties of setting up your business.

There are numerous compliance related aspects involved with setting up a business. Therefore, if the initial assessment is done, then you need to focus on such bureaucratic obligations, namely you have to decide what business structure in Australia your company should have.

Why Choosing a Business Structure in Australia Is Important

Unless you have some grounding in entrepreneurship, it’s possible that you don’t even think that choosing business structure in Australia is even important. However, as any seasoned businessman will tell you, the structure you choose for your business will often end up defining a variety of elements surrounding its operations.

Unless you have some grounding in entrepreneurship, it’s possible that you don’t even think that choosing business structure in Australia is even important. However, as any seasoned businessman will tell you, the structure you choose for your business will often end up defining a variety of elements surrounding its operations.

Your business structure will define how much tax you pay to the government, how much liability you take on your own shoulders, and even how much freedom you have in running your business. Typically, business structure in Australia is chosen on the basis of four factors. These are:

- The nature of your business,

- The number of owners,

- The number of employees,

- The size of future income, and

- The long term objectives and growth potential.

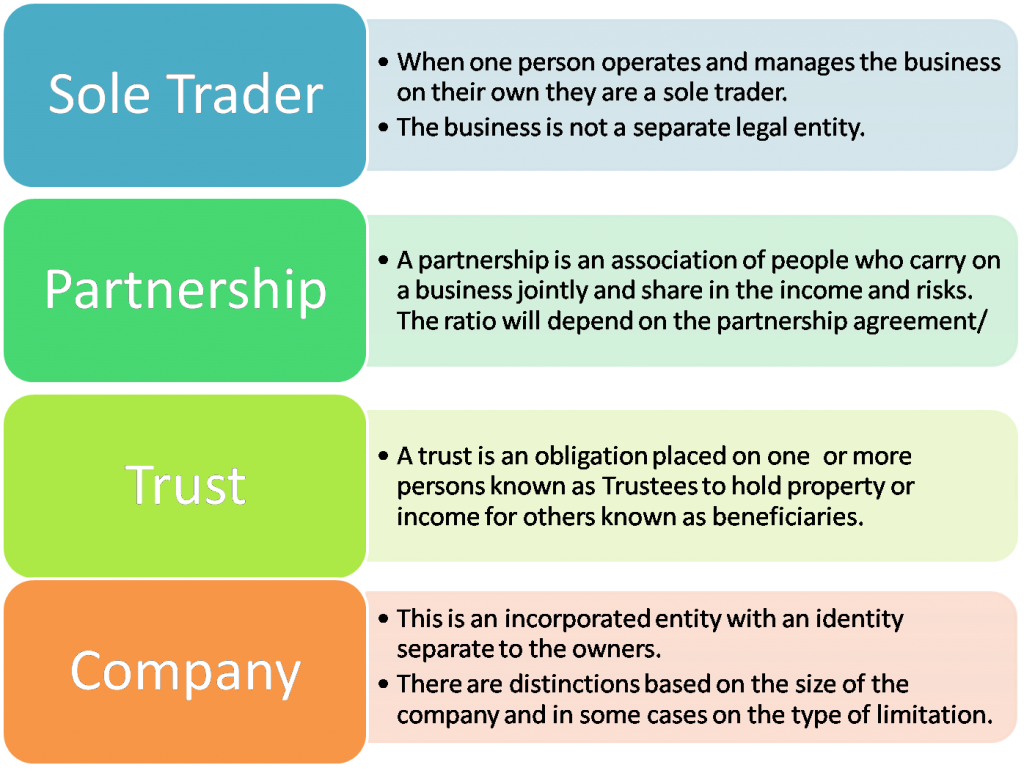

There are mainly four types of business structures that you can choose from which are Sole Trader, Partnership, Trust, and Company. Each business structure in Australia has its own pros and cons that need to be measured and weighed by every entrepreneur.

Sometimes, in the case of particular sectors and types of businesses, one structure may be more suitable over others but in the majority of cases, your choice will boil down to three things. These are how much time you’ll be devoting to your business, how much risk you’re willing to take, and how different types of paperwork will affect your business.

Ideally, you should be consulting a certified accountant or professional financial advisor to truly sift through the intricacies of your business structure in Australia. However, knowing the basics can be very helpful in those discussions. In fact, this basic knowledge may even allow you to find out how accomplished your advisor or accountant is. Moreover, it may end up saving you money.

Therefore, we present to you the four most common business structures in Australia along with their advantages and disadvantages. Consider the following.

Sole Trader

Sole Trader is easily the easiest business structure in Australia to create for any entrepreneur. Becoming a Sole Trader will make you the sole owner of your business which means that your business entity and you are closely tied together. Your business will not be treated as an entity separate from you.

Sole Trader is easily the easiest business structure in Australia to create for any entrepreneur. Becoming a Sole Trader will make you the sole owner of your business which means that your business entity and you are closely tied together. Your business will not be treated as an entity separate from you.

Your tax liabilities will, essentially, not be any different if you were an employee. Any money you make through your business will be treated as your income and you’ll have to pay taxes on them. Any losses your business suffers will be considered as your losses too.

When you choose Sole Trader as your business structure in Australia, you’ll be required to get an Australian Business Number or ABN. ABNs are given by the Australian Tax Office too all business types in Australia except for a business that registers as a company.

The biggest benefit of choosing the Sole Trader business structure in Australia is that it is incredibly easy to set up. In fact, apart from being easy to set up, it is also the most economical to set up.

Moreover, as a Sole Trader, you’ll have the maximum control over your business and can take decisions without any external interference. You wouldn’t even have to worry much about compliance related issues and legal requirements as a Sole Trader which means lesser bureaucratic hassles and government prerequisites to wade through.

However, there are downsides of the Sole Trader business structure in Australia too. First and foremost, being a Sole Trader puts all business related liability on your shoulders since there is no legal separation between you and your company. Also, as a Sole Trader, you would find it extremely difficult to get financial support from third parties such as investors, banks, and other financial institutions.

Partnership

As the name suggests, the Partnership business structure in Australia usually means that the business has two or more owners. The nature of the shared ownership between multiple owners of a business is defined by a partnership agreement which also contains stipulations concerning other business related matters.

As the name suggests, the Partnership business structure in Australia usually means that the business has two or more owners. The nature of the shared ownership between multiple owners of a business is defined by a partnership agreement which also contains stipulations concerning other business related matters.

For instance, it isn’t uncommon for partnership agreement to contain legal stipulations pertaining to loans, terminations, salaries, and liabilities etc. Moreover, any income that the business makes is shared by the partners on the basis of what stakes they own in the business. This is also defined in the partnership agreement.

Partnership business structure in Australia also requires an ABN along with an independent tax file number. The biggest advantage of partnership is that liabilities, risks, and responsibilities become shared between multiple parties. Moreover, with more partners comes more varied expertise. It is also easier to raise funds with multiple partners.

The biggest disadvantage of the partnership business structure in Australia is that every partner has to shoulder risks and liability related to the business. Apart from this, another downside is that, in the majority of cases, partners also share authority when it comes to business matter and no single partner can make decisions without the others’ involvement.

Trust

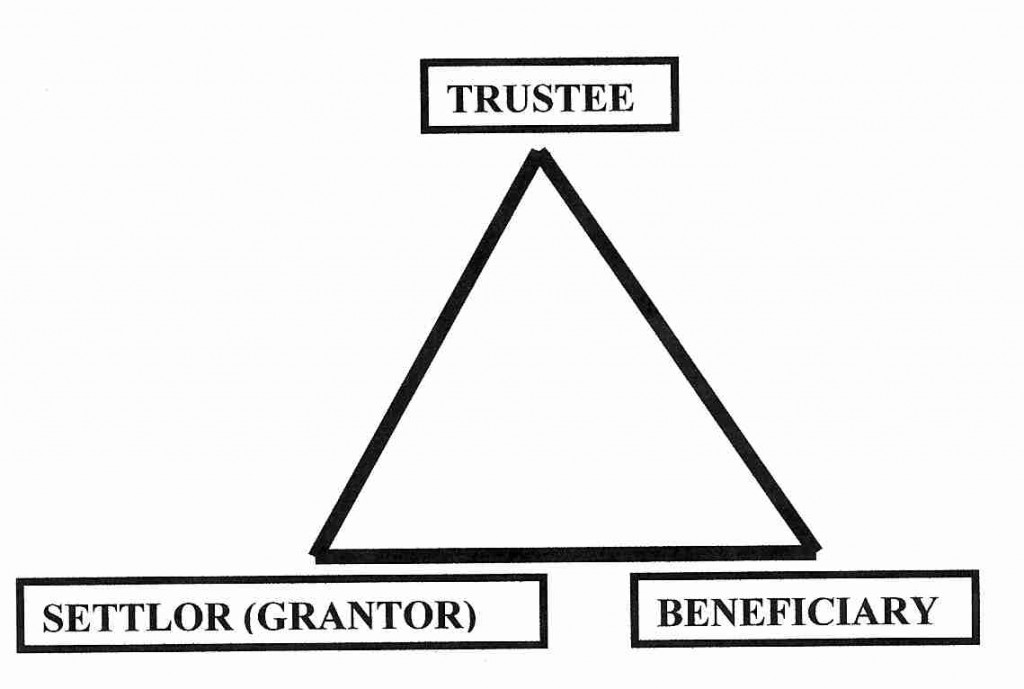

The trust business structure in Australia is easily the most complicated. There are not only multiple types of trusts but also multiple ways through which it can be created and managed. It is usually a company that acts as the trustee for a trust. Trusts, like partnerships, require an ABN and an independent tax file number.

The trust business structure in Australia is easily the most complicated. There are not only multiple types of trusts but also multiple ways through which it can be created and managed. It is usually a company that acts as the trustee for a trust. Trusts, like partnerships, require an ABN and an independent tax file number.

The primary advantage of a trust is that it provides the entrepreneurs with the option of limited liability in certain circumstances. This coupled with the fact that there is more flexibility in trusts with respect to income distribution means that trusts can be more private and versatile for businessmen.

The primary disadvantage of the trust business structure in Australia is that it is one of the most difficult and expensive to set up. In fact, its inherent difficulty is such that business counsellors only advise setting up a trust when no other viable option is available. As mentioned earlier, setting up trusts is more complicated because of complex legal requirements and compliance prerequisites.

Company

The company business structure in Australia is one of the more popular ones mainly because of its benefits. Companies are registered with the authorities and can have more than one shareholder. Any profit the business makes is shared between the shareholders of the company. The leaders of the company such as Directors and Managing Directors are treated as employees of the company and paid a salary.

The company business structure in Australia is one of the more popular ones mainly because of its benefits. Companies are registered with the authorities and can have more than one shareholder. Any profit the business makes is shared between the shareholders of the company. The leaders of the company such as Directors and Managing Directors are treated as employees of the company and paid a salary.

Most importantly, it is possible for the owner of the company to also be the Director of the company which means that he gets profits through his shareholding and a salary. Companies need to have an Australian Company Number or ACN which is issued by the Australian Securities and Investment Commission (ACN). The company will also have its separate tax file.

The biggest advantage of incorporating a company is that it is treated as a separate entity from the owner. This means that financial liability of a company on its promoter is limited only towards the company’s assets. Companies also find it easier to raise finances than businesses based on any other business structure in Australia.

However, there are downsides of the company business structure in Australia too. There are strict regulations and compliance related requirements on financial recordkeeping on a company. Companies are also required to publicly disclose important pieces of information not only for credibility but also legally.

How to Decide?

Which business structure in Australia is ideal for your business idea depends entirely on your future plans and projections. Moreover, they also depend on other aspects surrounding your personal situation as well as the industry you plan to enter.

In the majority of cases, the information provided above should be good enough for you to pick an option to research further. Speaking to financial advisors, business counsellors, and accountants can also be helpful to understand the more specific nuances.

Leave a Reply