You know, every entrepreneur out there didn’t start out with a ton of cash. While there are many entrepreneurs out there who were born with a silver spoon, a few actually had to work hard to raise enough business funding before they could make their dreams of owning a business come true.

You know, every entrepreneur out there didn’t start out with a ton of cash. While there are many entrepreneurs out there who were born with a silver spoon, a few actually had to work hard to raise enough business funding before they could make their dreams of owning a business come true.

In the last post of this Startup Strategy series, we explained how you can create your business logo because image is important. However, from this instalment onwards, it is time for us to go really deep into the business of doing business.

In this post, we’re going to talk about what you can do to ensure that your business is ready to apply for third party business funding, whether it is through venture capitalists or through formal financial institutions such as banks.

The Need to Raise Business Funding

It is true that every budding entrepreneur doesn’t have enough funding to start his business independently. In fact, many people come up with wonderful business ideas but never translate them into working businesses because they’re afraid of taking risks.

It is true that every budding entrepreneur doesn’t have enough funding to start his business independently. In fact, many people come up with wonderful business ideas but never translate them into working businesses because they’re afraid of taking risks.

Getting business funding from an external source is the perfect way to mitigate the inherent risk of setting up your business. However, it isn’t so easy to get approved for that external loan. The trick is to prepare your business in a way so that its chances of being approved for the loan increase.

Here, we’ll help you chart your business funding preparations and show you what you need to improve your approval chances.

Write a Business Plan

Your business plan will be the foundation for you to get business funding from external sources. Whether you approach government approved loan providers, formalised financial institutions like banks, or venture capitalists, your business plan will be the first thing they consider.

Your business plan will be the foundation for you to get business funding from external sources. Whether you approach government approved loan providers, formalised financial institutions like banks, or venture capitalists, your business plan will be the first thing they consider.

As a matter of fact, wherever you apply for business funding, your business plan will be the face of your application.

Your business plan will be the key to not only getting approved for external business funding but also sorting your own plans. Typically, your business plan can help you polish and refine your business idea into working shape. When you write your business plan, you’ll start seeing your business idea from the perspective of loan providers.

This will help you foresee potential problems, restrictions, limitations, and flaws which you can then go about resolving. Effectively, it is advisable that you put in a lot of effort and time in writing your business plan so that it reflects the reasons why you think your business idea is good.

Arrange Pre – Contracts and Agreements

There’s nothing that investors like more than a business that is already on its way and an entrepreneur willing to commit to his idea. You can show that you’re ready to commit to your business by actually sourcing and arranging pre – contracts and agreements.

There’s nothing that investors like more than a business that is already on its way and an entrepreneur willing to commit to his idea. You can show that you’re ready to commit to your business by actually sourcing and arranging pre – contracts and agreements.

However, just mentioning pre – contracts and agreements along with your business plan isn’t enough. You’ll need to furnish proof of the same. This means that you’ll have to arrange for written and legal contracts and agreements that you can tack on to your business plan to give it more substance.

Define an Exit Strategy or Plan B

While confidence is a good trait in a businessman, foresight and meticulous planning skills are even more important. This is why many third party business funding providers look askance at an entrepreneur who doesn’t have an exit strategy or a Plan B for his business.

While confidence is a good trait in a businessman, foresight and meticulous planning skills are even more important. This is why many third party business funding providers look askance at an entrepreneur who doesn’t have an exit strategy or a Plan B for his business.

The trick is the plan for the worst and hope for the best. Therefore, within your business plan or separately in business funding application, it is advisable to describe what your exit strategy or Plan B is with your business.

Display Your Knowledge of the Industry

Not a single businessman can succeed without understanding his sector, market forces, and target audience. It is obvious that this basic fact is known by all third party business funding providers.

Not a single businessman can succeed without understanding his sector, market forces, and target audience. It is obvious that this basic fact is known by all third party business funding providers.

Therefore, if a businessman displays knowledge pertaining to his business, then he is more likely to have his application approved. However, this knowledge doesn’t have to be displayed in an arrogant and cocky manner.

Instead, it should be subtle and wise. One of the better ways of displaying your knowledge of your sector, the relevant market forces, and your target audience is to use these facts as evidence of your business succeeding.

It is entirely possible to take statistics and trends to show that the market is in your favour. It is also possible to make viable forecasts about market forces based on statistics and trends. These are some tricks you should use in your business plan.

Determine and Present a Personal Survival Budget

Assessors of business funding applications aren’t only concerned about the health of the business that is going to be set up but also the entrepreneurs who’ll be doing the setting up. The reason for this is that they understand the importance of the entrepreneurs’ health in the health of the business.

Assessors of business funding applications aren’t only concerned about the health of the business that is going to be set up but also the entrepreneurs who’ll be doing the setting up. The reason for this is that they understand the importance of the entrepreneurs’ health in the health of the business.

This is why the concept of Personal Survival Budget exists. Personal Survival Budget addresses the needs of the owner of the business. It is the estimated sum of money that the owner will need to continue his current lifestyle without hindrance. This includes everything from childcare and food to essential utility bills.

Many third party business funding providers consider this estimate to determine how sustainable the business is because if the owner is unable to continue his lifestyle, then the business will suffer as well.

Create a Cash Flow Projection Document

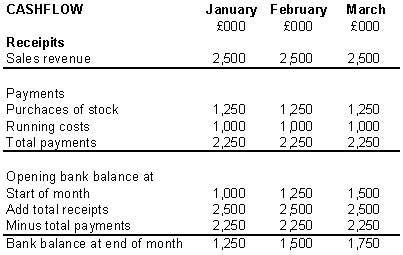

If there’s one thing that external business funding providers want, then it’s an entrepreneur who can think into the future. Since their primary concern will always be how their money will be used, it would be a good idea for the entrepreneur to supplement his business plan with a cash flow projection document. This document, as is obvious, will contain cash flow projections.

If there’s one thing that external business funding providers want, then it’s an entrepreneur who can think into the future. Since their primary concern will always be how their money will be used, it would be a good idea for the entrepreneur to supplement his business plan with a cash flow projection document. This document, as is obvious, will contain cash flow projections.

This means that you, as the entrepreneur, will have to project all your expenses and match them with sources of income. Cash flow projection documents shouldn’t just be treated as projected balance sheets. While projected balance sheets must be a part of the cash flow projection document, it is also advisable to include graphs and charts to depict the business’s growth.

When you take business funding from a third party, you’re essentially taking a loan out unless that institution or individual agrees to become your investor. As a result of this, it is possible that your loan application will benefit if you demonstrate that you’re capable of managing debt. Therefore, if you’ve taken loans before, then it may be prudent to mention them and their respective timely repayments.

Connect Your Business Plan with Your Cash Flow Projections

It is common for budding entrepreneurs to treat cash flow projections and business plan as separate documents. They create the two separately at different times without any correlation and connection between them, when the exact opposite is recommended for getting approval for external business funding.

Ideally, you want your business plan to refer to your cash flow projections document at a regular basis. Moreover, you should also be citing numbers from the cash flow projections document so as to show the application assessor that you’ve thought of everything pertaining to your business on an in-depth level.

You should also make sure that everything tallies between your business and plan and cash flow projections document. If there are discrepancies as can happen when you provide projections for different scenarios, you should make sure that you explain them clearly as well.

Leave a Reply